Nys Estimated Tax Payments 2025 Voucher

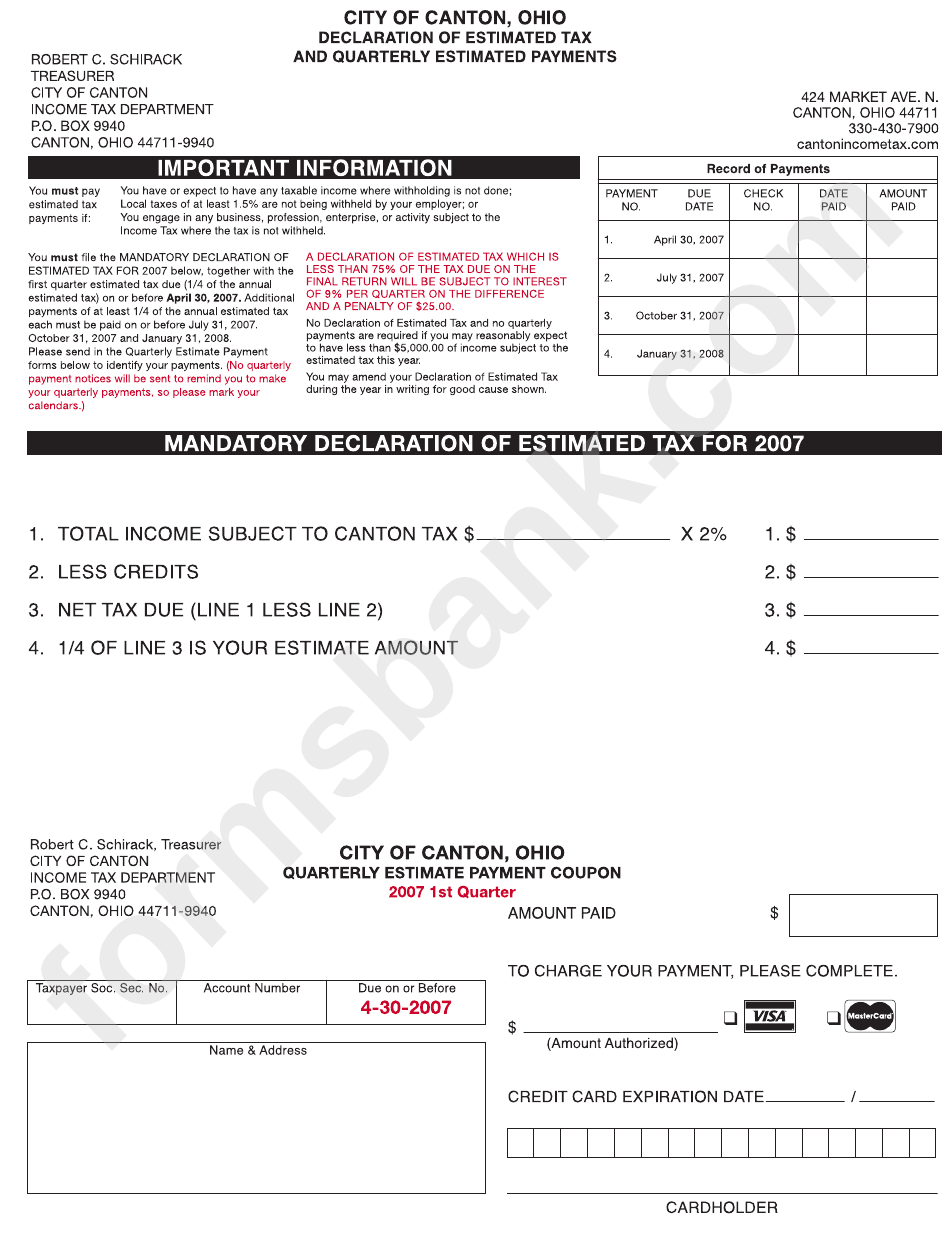

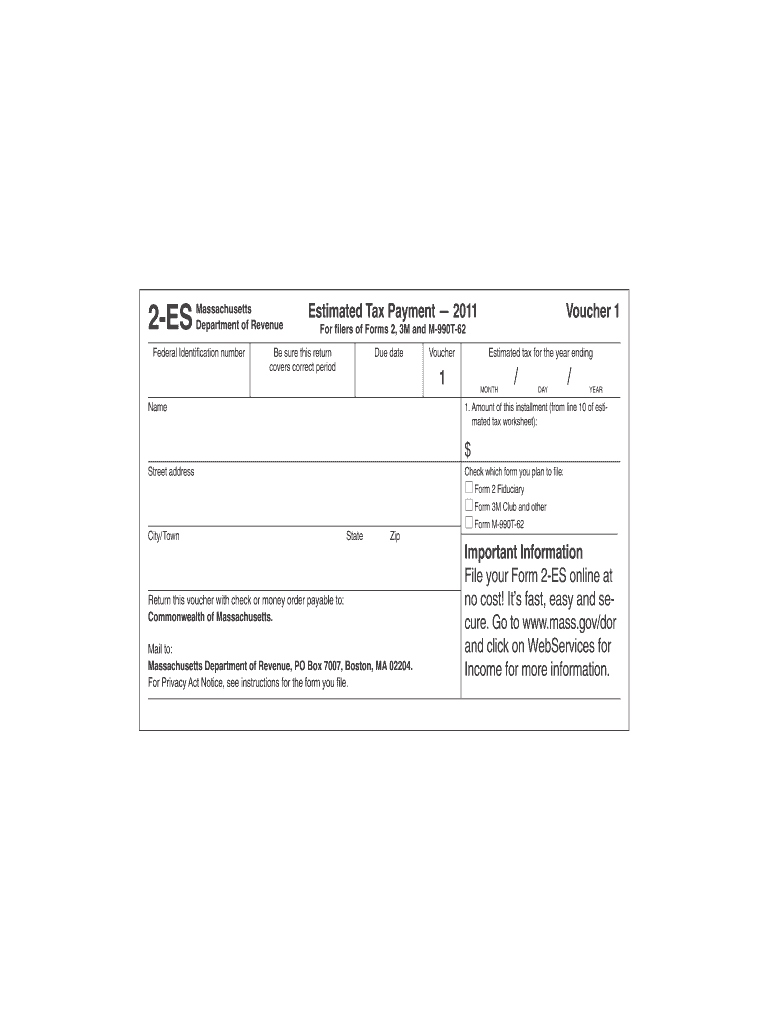

Nys Estimated Tax Payments 2025 Voucher. Instead of sending a paper check with a payment voucher, individuals and businesses can make return payments electronically through masstaxconnect. Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty.

100% of the tax on your 2025 estimated taxable income. You must send payment for taxes in new york for the fiscal year 2025 by april 15, 2025.

Four of these options are based on a percentage of tax from both the prior year and the current year.

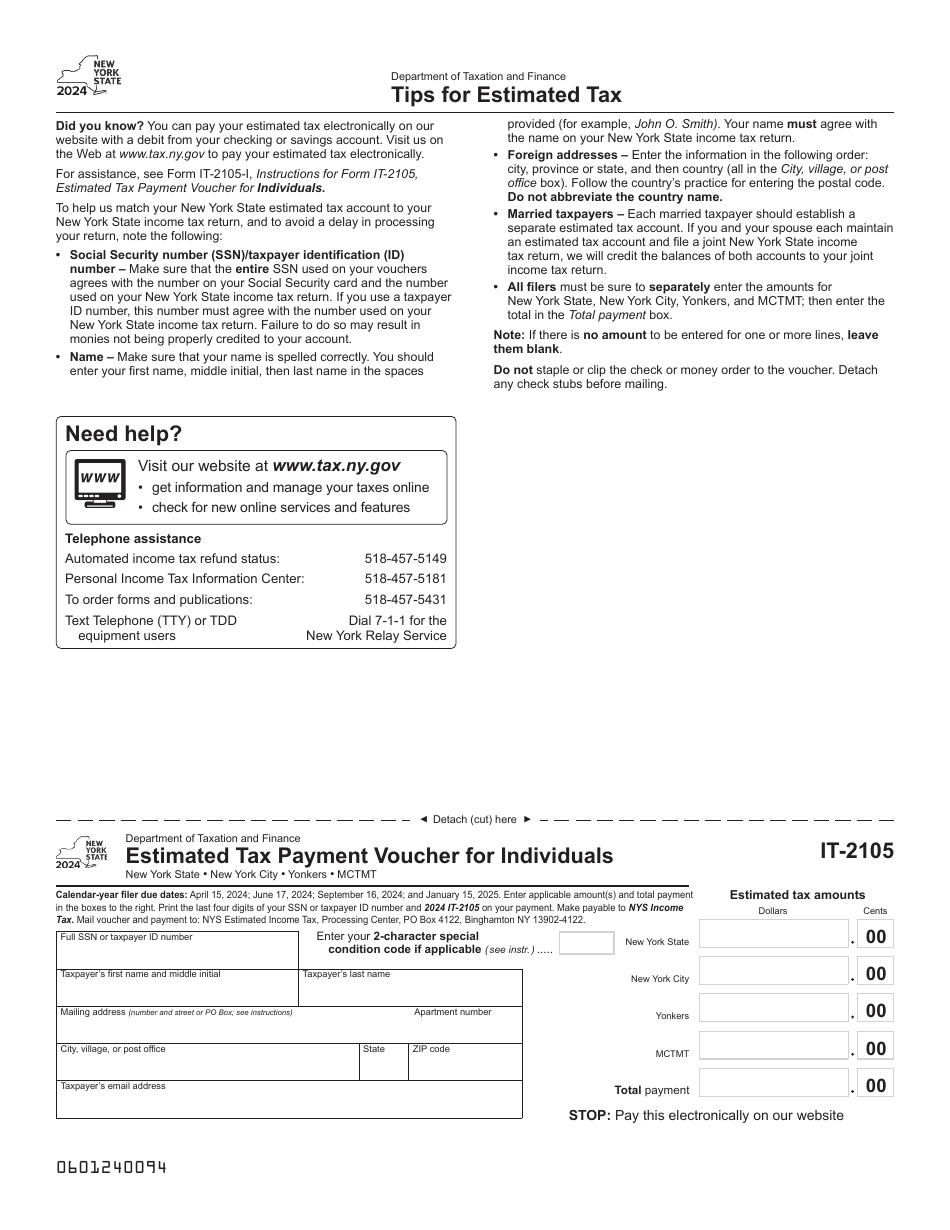

Estimated Tax Payments 2025 Vouchers Drucie Linnell, You can pay your estimated income tax online using your individual online services account or tax preparation software. How do i get a 4th quarter voucher in a nyc corporation return?

Nys Estimated Tax Forms 2025 Janie Lisette, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. When paying estimated taxes, you.

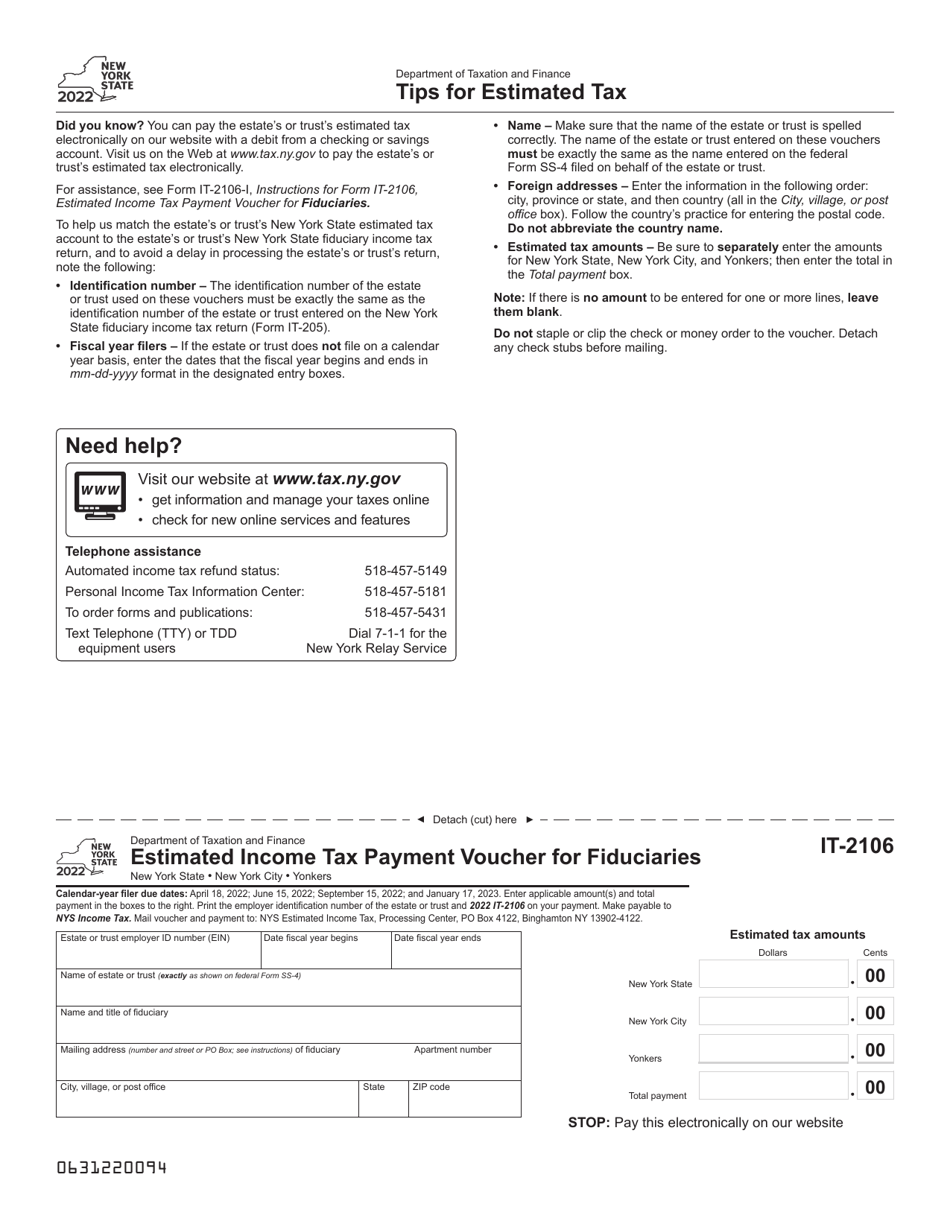

Form IT2106 Download Fillable PDF or Fill Online Estimated Tax, 100% of the tax on your 2025 estimated taxable income. Both are convenient, secure, and easy.

2024Es 2025 Estimated Tax Payment Vouchers Delora Kendre, Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty. These options are to pay:

Irs Estimated Tax Payments 2025 Dotti Gianina, However, the 2nd quarter is due 6/15/20. To calculate your state of ct quarterly estimated tax payments, you must estimate your adjusted gross income, deductions, and credits for the calendar year 2025.

2025 Tax Deadlines for the SelfEmployed, You're not required to make estimated tax payments; You can meet this requirement through withholding or estimated tax payments.

Nys Tax Payment Plan Form, The extension deadline is october 15, 2025, to file your new york individual income tax return. Enter any overpayment, and then, by quarter, any estimated payments made.

Nys Estimated Tax Payments 2025 Nelly Yevette, These options are to pay: How do you make estimated tax payments?

Estimated Tax Payments 2025 Forms Vouchers Daron Emelita, You can pay your estimated income tax online using your individual online services account or tax preparation software. Both are convenient, secure, and easy.

Irs Estimated Tax Payment Form 2025 Deana Estella, When paying estimated taxes, you. You must send payment for taxes in new york for the fiscal year 2025 by april 15, 2025.

Once you file the form 1040, there's no way to submit estimated payments for electronic funds withdrawal in proseries.